In today’s fast-paced world, financial technology transforms how we handle money. Asia leads this revolution. FTasiaFinance stands at the forefront of this change.

This platform combines cutting-edge technology with financial services. It’s creating waves across the Asian market. Traditional banks are taking notice. Small businesses are benefiting. Consumers enjoy unprecedented access to financial tools.

What is the Business Trend of FTAsiaFinance?

FTasiaFinance is an emerging fintech platform transforming financial services in Asia. It connects businesses with advanced financial tools. The platform focuses on accessibility and efficiency. FTasiaFinance is not just another financial app.

It represents a wider movement toward digital banking solutions. Small businesses can now access services once reserved for large corporations. Innovation drives every aspect of the platform. The core strength of FTasiaFinance lies in its simplicity.

Users can manage multiple financial tasks in one place. The platform integrates seamlessly with existing systems. It offers solutions for payments, lending, and investment.

FTasiaFinance uses secure technology to protect user data. The user interface remains intuitive despite powerful capabilities. Many businesses report significant time savings after adoption.

Key Drivers of Business Trend FTasiafinance

Several factors are accelerating FTasiaFinance’s growth in the market:

- Digital wallets adoption has skyrocketed post-pandemic

- Artificial intelligence enables personalized financial advice

- Growing demand for financial inclusion across Asia

- Increasing comfort with mobile banking solutions

- Regulatory sandboxes encourage fintech innovation

- Rise of the digital economy creates new opportunities

- Cloud computing reduces infrastructure costs

- User experience focuses on simplicity and accessibility

- Big data allows for better decision-making

- Open banking initiatives remove traditional barriers

The convergence of these factors creates perfect conditions for FTasiaFinance to thrive. Traditional banking couldn’t keep pace with digital demands. FTasiaFinance filled this gap effectively. Now even conservative financial institutions are partnering with the platform. This signals a fundamental shift in the industry landscape.

Sector-Specific Business Trend FTasiafinance Analysis

Banking Sector

Banks integrate FTasiaFinance to enhance customer service. They maintain compliance while becoming more agile. Legacy systems connect to modern interfaces. Customer satisfaction scores improve dramatically. Fraud detection becomes more sophisticated through AI integration.

Retail Industry

Retailers use FTasiaFinance to streamline payment processes. They offer buy now pay later options without assuming risk. Customer loyalty increases through personalized offers. Inventory management improves with financial forecasting tools. Small shops compete more effectively with larger chains.

Healthcare Organizations

Healthcare providers simplify billing through FTasiaFinance. Patient payment plans become easier to manage. Insurance claims process faster with standardized systems. Administrative costs decrease significantly. Patient financial experience improves noticeably.

Real Estate Market

Property transactions move faster with FTasiaFinance solutions. Buyers access mortgage options instantly. Developers secure project funding more easily. Risk assessment becomes more accurate. Cross-border investments face fewer hurdles.

E-commerce Platforms

Online stores reduce cart abandonment with FTasiaFinance payment options. They expand to international markets easily. Currency conversion happens automatically. Cybersecurity measures protect customer data. Subscription models become easier to manage.

The Role of Data in Business Trend FTasiafinance

Data serves as the foundation of FTasiaFinance’s capabilities. Every transaction generates valuable insights. These insights improve future operations. Data-driven insights create competitive advantages. Financial decisions rely less on intuition and more on facts.

FTasiaFinance employs machine learning to analyze spending patterns. It identifies potential fraud in real-time. Customer preferences shape product recommendations. Predictive analytics forecast market trends with surprising accuracy. All this happens while maintaining strict privacy standards.

- Financial behavior patterns reveal business opportunities

- Transaction data improves lending decisions

- Customer feedback refines user interfaces

- Market analysis identifies emerging trends

- Big data processing occurs in milliseconds

The platform’s AI-driven solutions continue learning from each interaction. This creates a constantly improving ecosystem. Users benefit from increasingly personalized experiences. Businesses make better strategic decisions based on solid data.

READ THIS BLOG: Enhance Your Microsoft Lync Experience with Lync Conf Mods

Global Impacts of Business Trend FTasiafinance

The influence of FTasiaFinance extends beyond Asian markets. Global financial systems take note of its success. Western institutions adopt similar approaches. Cross-border payments become simpler and cheaper. International businesses find new efficiencies.

FTasiaFinance facilitates trade between diverse economies. It standardizes financial communications across borders. Currency fluctuations affect businesses less. Financial integration occurs at unprecedented speeds. Developing markets gain access to sophisticated tools.

- Removal of traditional barriers to international trade

- Acceleration of global financial inclusion

- Standardization of financial protocols

- Reduction in transaction costs

- Expansion of market access for small businesses

The fintech ecosystem worldwide grows stronger through competition. Innovation spreads more quickly between regions. Financial literacy improves as tools become more accessible. These changes represent a fundamental shift in global commerce.

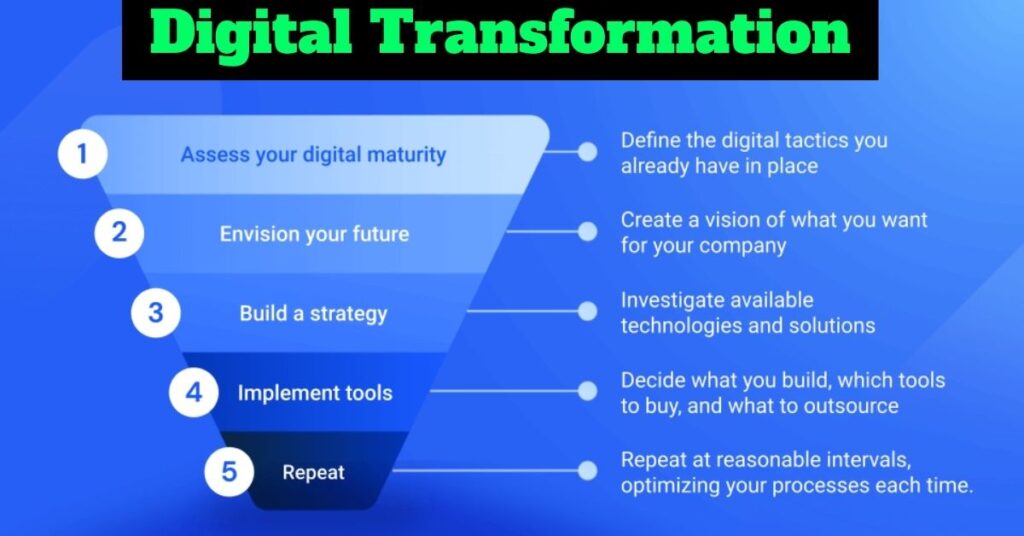

Step-by-Step: Digital Transformation with FTAsiaFinance

Implementing FTasiaFinance requires a methodical approach:

- Assess current financial workflows and pain points

- Identify specific FTasiaFinance solutions that match your needs

- Start with a limited implementation to test the effectiveness

- Train team members on new systems and processes

- Gradually expand implementation across departments

- Monitor performance metrics and adjust as needed

- Integrate with existing software through available APIs

- Collect user feedback and request necessary adjustments

- Scale solutions as business needs grow

- Stay updated on new features and capabilities

This measured approach reduces disruption to ongoing operations. It allows for course correction when needed. Teams adapt more easily to gradual changes. Digital transformation succeeds through careful planning and execution. FTasiaFinance provides support throughout this journey.

Overcoming Challenges

Adopting FTasiaFinance comes with certain obstacles. Understanding these challenges helps prepare effectively. Most businesses face similar issues during implementation. Preparation minimizes their impact.

- Regulatory compliance requirements vary by country

- Legacy system integration requires technical expertise

- Employee resistance to new processes must be addressed

- Cybersecurity concerns need a thorough examination

- Data migration demands careful planning

- Initial setup costs may strain limited budgets

- Training requires time investment from busy staff

- Customization needs vary between departments

- Risk assessment must account for new processes

- Measuring ROI takes time and proper metrics

Successful implementations address these challenges proactively. FTasiaFinance provides resources for common obstacles. Their support team helps navigate complex issues. Most businesses report challenges were smaller than anticipated. The benefits quickly outweigh the difficulties faced.

Why Choose FTAsiaFinance?

FTasiaFinance offers distinct advantages over competitors. The platform prioritizes user experience above all. Technical complexity remains hidden behind intuitive interfaces. Support teams understand both finance and technology. Solutions scale with your business growth.

- Built specifically for Asian market needs

- Stronger cybersecurity measures than competitors

- Faster implementation timeframes

- More flexible integration options

- Better understanding of regional regulations

- More personalized customer service

- Stronger focus on small business needs

- More transparent pricing structures

- More frequent feature updates

- Deeper commitment to financial inclusion

The platform’s dedication to continuous improvement stands out. User feedback directly influences development priorities. This creates solutions that truly address market needs. Businesses feel valued rather than just being customers. The partnership approach differentiates FTasiaFinance from alternatives.

READ THIS BLOG: First Page Of Google Search David Aziz: Ultimate Guide, Tips & Tricks

Future of Business Trend FTasiafinance

The trajectory for FTasiaFinance points toward continued expansion. Several emerging technologies will enhance its capabilities. Market trends suggest increasing adoption rates. Regional expansion plans are already underway. The future looks promising on multiple fronts.

- Blockchain integration will improve transaction security

- Decentralized finance options will expand investment opportunities

- Voice-activated banking will improve accessibility

- Advanced AI-driven solutions will provide deeper insights

- Fintech-as-a-Service will become more customizable

- ESG considerations will influence financial decisions

- Biometric security will enhance protection measures

- Smart banking will anticipate customer needs

- Innovation will focus on underserved markets

- Banking and lifestyle services will further merge

These developments will strengthen FTasiaFinance’s market position. Early adopters will gain competitive advantages. The gap between traditional and digital finance will continue widening. Forward-thinking businesses are preparing now for these changes.

Strategies for Leveraging Business Trend FTasiafinance

Maximizing the benefits of FTasiaFinance requires strategic thinking. Consider these approaches:

- Start with high-impact, low-complexity implementations

- Create cross-functional teams to manage the transition

- Establish clear metrics to measure success

- Provide comprehensive training for all users

- Regularly review and optimize your implementation

- Stay informed about new features and capabilities

- Connect with other users to share best practices

- Use data insights to drive business decisions

- Balance automation with human oversight

- Create feedback loops for continuous improvement

These strategies help extract maximum value from the platform. They turn technological tools into business advantages. The most successful implementations follow these principles. They balance immediate needs with long-term vision. This approach creates sustainable digital growth.

FAQs

Which industries benefit most from FTasiaFinance?

Retail, e-commerce, healthcare, and real estate see the strongest immediate benefits. Digital solutions improve their transaction-heavy operations significantly.

How does FTasiaFinance ensure data security?

The platform employs bank-grade encryption, regular security audits, and continuous monitoring systems. They maintain compliance with all regional data protection regulations.

Can small businesses afford FTasiaFinance solutions?

Yes, the platform offers scalable pricing based on business size and usage. Entry-level packages make advanced financial tools accessible to even small operations.

What integration options exist for existing systems?

FTasiaFinance provides API connections, direct database integration, and middleware solutions. Most businesses achieve functional integration within days rather than weeks.

How quickly can businesses implement FTasiaFinance?

Basic implementation typically takes 2-4 weeks. Full integration across multiple departments may require 2-3 months depending on complexity and organizational readiness.

Conclusion

FTasiaFinance represents more than just another fintech solution. It symbolizes a fundamental shift in financial services. The platform combines technological innovation with practical business applications. Its continued growth reflects changing market demands. Forward-thinking businesses gain significant advantages through early adoption. The financial landscape continues evolving rapidly. Traditional institutions struggle to keep pace.

FTasiaFinance bridges this gap effectively. It democratizes access to sophisticated financial tools. Small businesses compete more effectively using these resources. Consumers enjoy better financial experiences as a result.

Smith is a seasoned SEO expert with a passion for content writing, keyword research, and web development. He combines technical expertise with creative strategies to deliver exceptional digital solutions.

![Aeonscope Insights: The Ultimate Guide to Transforming Your Business Data [2025] Aeonscope Insights: The Ultimate Guide to Transforming Your Business Data [2025]](https://todaystats.info/wp-content/uploads/2025/05/Add-a-heading-68-150x150.jpg)